nassau county tax grievance form

Submitting an online application is the easiest and fastest way. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Submitting an online application is the easiest and fastest way.

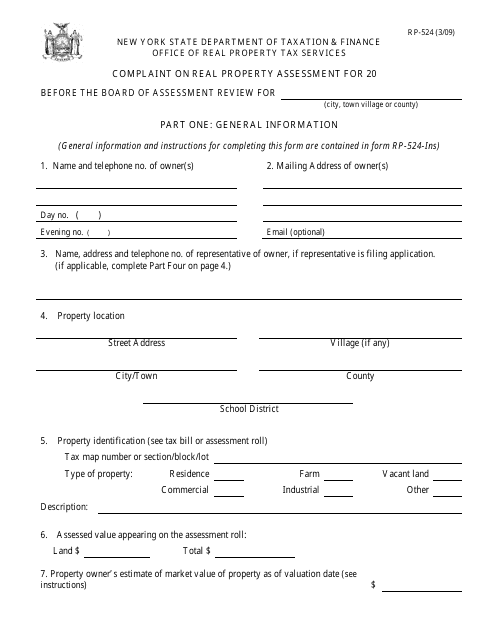

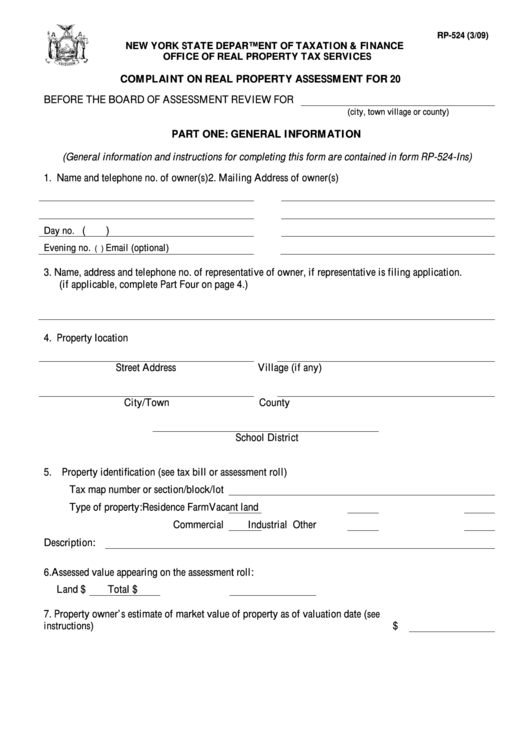

. Click this link if you prefer to print out the application in PDF form and fax it to. The undersigned being an aggrieved party within the meaning of the Real Property Tax Law hereby authorizes the below representative to act as our agent to file with the Nassau County Assessment Review Commission. Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment.

Completing the grievance form Properties outside New York City and Nassau County. File the grievance form with the assessor or the board of assessment review BAR in your city or town. ARCs services for homeowners commercial taxpayers and tax.

Again well keep you in the loop with regular communications as your case makes its way through ARCs review process and if necessary through a SCAR proceeding. The form can be completed by yourself or your representative or attorney. Nassau County Tax Reduction Application.

Notice of Disclosure of Interest of Board of Assessment Review Member in Parcel for Which Assessment Complaint Has Been Filed. RP-524 Fill-in RP-524-Ins Instructions Complaint on Real Property Assessment for 20__ 11x17 print format For more information. Nassau County Tax Grievance Form.

Click this link if you prefer to print out the application in PDF form and fax it to 631-782-3174. Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment. Click this link if you prefer to print out the application in PDF form and fax it to.

For a 1 2 or 3 Family House pdf file Instruction for form AR1. Click this link if you prefer to print out the application in PDF form and fax it to. Nassau County Legislature District 1 - Kevan Abrahams.

Access your personal webpage or sign date and return our tax grievance authorization form prior to the deadline Nassau Countys deadline to file a property tax grievance is approximately 18 months in advance of the tax year being challenged barring any extensions. Ad Download Or Email Form RP-524 More Fillable Forms Register and Subscribe Now. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing Period to May 2 2022 The Assessment Review Commission - ARC - acts on appeals of county property assessments.

Ways to Apply for Tax Grievance in Nassau County. How do I grieve my Nassau County taxes. New York Tax Forms page.

Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment. File the grievance form with the assessor or the board of assessment review BAR in your city or town. Joseph Barrera Lighthouse Tax Grievance Corp Rep.

Click Here to Apply for Nassau Tax Grievance. This website will show you how to file a property tax grievance for you home for FREE. File the grievance form with the assessor or the board of assessment review BAR in your city or town.

However the property you entered is not located in Nassau County and we only file tax grievances for Nassau County properties. 81 Guardianship proceedings PDF. Click Here to Apply for Nassau Tax Grievance.

We offer this site as a free self help resource for people like you that want to. The form can be completed by yourself or your representative or attorney. Instructions For TP584 PDF TP584 Form PDF Fill In TP5841 Form Instructions For IT2663 PDF 2021.

NASSAU COUNTY PROPERTY TAX GRIEVANCE FORM. The form can be completed by yourself or your representative or attorney. Use Form RP-524 Complaint on Real Property Assessment to.

Get Free Commercial Analysis. Proposed Short Form Commission for Art. ARC s online Sales Locator is available to help you evaluate the accuracy of the new assessment for your.

Or 4The estate of a deceased homeowner is eligible under law to receive a tax assessment reduction and a property tax refund. RP-523-Dcl Fill-in Instructions on form. For Other types Property pdf file Instruction for form AR2.

You may file an online appeal for any type of property including commercial property and any type of claim including errors in your propertys tax class or exemptions. Filing the grievance form Outside of New York City and Nassau County use Form RP-524 Complaint on Real Property Assessment to grieve your assessment. NASSAU COUNTY PROPERTY TAX GRIEVANCE FORM.

Eligibility 1A person named in the records of the Nassau County Clerk as a homeowner. For more information on the property tax grievance process in Nassau County please see our Frequently. File the grievance form with the assessor or the board of assessment review BAR in your city or town.

Or you can call us at 516-342-4849. At the request of Nassau County Executive Bruce A. Table Of Contents Nassau County.

The New York state sales tax rate is currently 4. However the property you entered is not located in Nassau County and we only file tax grievances for Nassau County properties. O r 3A person who has contracted to buy a home.

Legislator Kevan Abrahams Presents Free Tax Grievance Workshops Jan 25th 2022 12PM-2PM Jan 27th 2022 Thursday 12PM-2PM and Feb 17th 2022 Thursday 7PM-9PM. Filing the grievance form Properties outside New York City and Nassau County. Ad Download Or Email Form RP-524 More Fillable Forms Register and Subscribe Now.

Useful Tax Grievance Links for Nassau County. At the request of Nassau County Executive Bruce A. Or 2That persons authorized agent.

For Tax Class and Exemption Claims pdf file Instruction for form AR3. Ways to Apply for Tax Grievance in Nassau County. These are the official forms for use in Nassau County Court proceedings.

For example the deadline to file a 20232024 tax grievance is May 2 2022. Ways to Apply for Tax Grievance in Nassau County. Between January 3 2022 and March 1 2022 you may appeal online.

Nassau County Tax Grievance Application - Tax. The form can be completed by yourself or your representative or attorney. Submitting an online application is the easiest and fastest way.

Know that your grievance is in the best most competent hands possible. You can follow our step-by-step instruction to file your tax grievance with the Nassau County Department of Assessment to have your property taxes lowered for FREE or have one of our staff file you grievance for you. It would be our pleasure to assist you.

The Nassau County sales tax rate is 425. Click Here to Apply for Nassau Tax Grievance. This is the total of state and county sales tax rates.

Ways to Apply for Tax Grievance in Nassau County. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing Period to May 2 2022.

Make Sure That Nassau County S Data On Your Property Agrees With Reality

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Form Rp 524 Form Ead Faveni Edu Br

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Nc Property Tax Grievance E File Tutorial Youtube

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Grievance Form Rp 524 Form Ead Faveni Edu Br

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Table Of Contents Nassau County

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

Nassau County Property Tax Reduction Tax Grievance Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island

Platinum Tax Grievances Home Facebook

District 3 Carrie Solages Nassau County Ny Official Website

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island